Disclaimer: This column is a guest column and does not represent an endorsement of its findings or suggestions by the BIM Bulletin staff or of the school. All predicted values are not absolute and estimate the growth of the IVV and S&P 500 indexes.

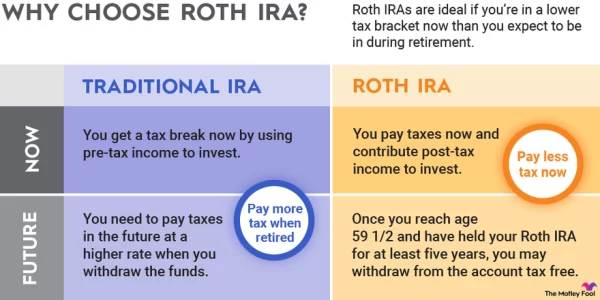

The Roth IRA (Individual Retirement Account) is the biggest giveaway the government has to offer. The way the Roth IRA works is that after-tax money goes in, your contributions and earnings can grow tax-free. While there are no current-year tax benefits, you can withdraw your contributions tax-free and penalty-free after age 59 and ½.

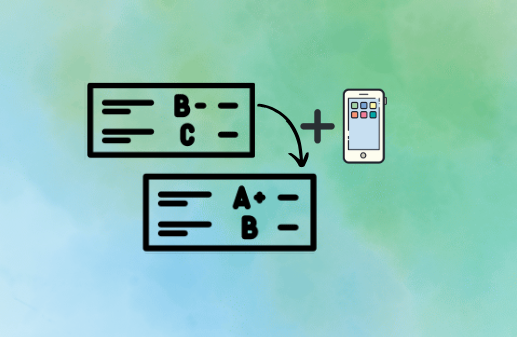

The chart below highlights the difference between a traditional IRA and a Roth IRA.

Here’s the best part: As a teen, if you have a part-time job, starting a Roth invested in the S&P 500 is exceptionally remunerative. If you have earned income that is declared on your parents’ tax return, then your parents can match the amount up to earned income (up to six thousand dollars). For example, if Carl the Hawk made $1000 one year, but he doesn’t want to contribute all of that to a Roth IRA, his parents can contribute the money directly to the Roth IRA as a gift, meaning Carl gets to keep his $1000 but also can still contribute to his retirement. Once that six thousand is invested into shares of IVV (a low-cost S&P 500 Index), by the time you reach retirement age, that six thousand will compound into over seven hundred thousand dollars tax-free. Those returns are just for one year of earned income. Imagine investing six thousand every year until you are 30. With consistent contributions to the Roth IRA, your total gains from the Roth IRA may amount to eight to nine million dollars.

There are many fine print rules for the Roth IRA such as an upper-income limit, but there are also additional benefits to a Roth IRA. Roth IRA funds can be withdrawn tax-free and penalty-free to pay for qualified higher education expenses and for the partial purchase of your first home (up to $10k). These rules can be found on the IRS website here.

As they say on Wall Street, “When the world is giving money away, line up early and often.” The Roth IRA is a powerful tool that you should utilize to secure your financial independence.